To determine the employee Double Holiday Rest day pay Double Holiday Rest day Pay = (Hourly rate × 300% × 8 hours) Php = (Php 5700 From 6 April the reference period for calculating holiday pay for variable hours workers will increase from 12 to 52 weeks The 52week reference period will function in the same way as the previous 12week period Employers must count back across the last 52 weeks that the employee has worked, and received pay Employees covered under the holiday pay rule should receive at least 100% of their salary, regardless if they reported to work or not Regular Holiday Computation Here is how you can compute your holiday pay on Regular Holidays Employees who did not work You should receive 100% of your salary for that day regardless Employees who worked

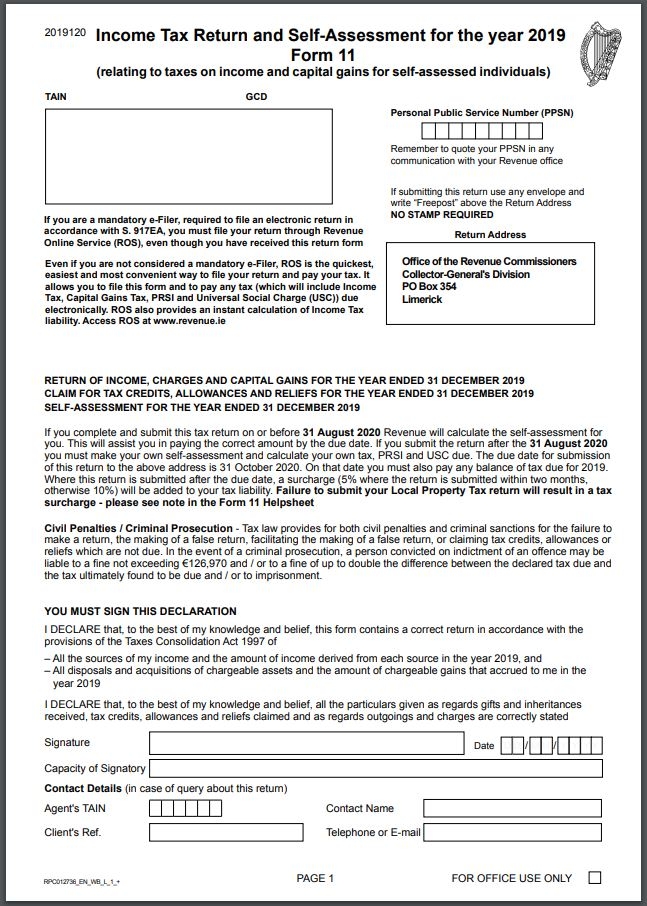

Simple Paye Taxes Guide Tax Refund Ireland